Economy and climate change are inextricably linked, shaping growth, jobs, and policy choices across every sector. This intersection matters for governments, businesses, and households as they navigate short-term volatility and long-term transformation. Understanding the economic impacts of climate change helps explain how policy, markets, and capital allocation respond to risk. By aligning with climate risk and policy, pursuing adaptation strategies for businesses, and advancing the green economy transition, stakeholders can direct investment toward resilience. A robust mix of climate finance and investment alongside transparent risk disclosure accelerates sustainable growth and expands opportunity.

The link between economic activity and a warming environment manifests in productivity, insurance costs, and investment risk. Policy signals, carbon pricing, and market expectations reshape where capital flows, guiding the shift toward a low-carbon, resilient economy. Businesses adapt through resilience planning, supply chain diversification, and climate-informed demand forecasting. Finance instruments such as green bonds and resilience funds help mobilize capital for clean energy, climate resilience, and sustainable growth.

Economy and climate change: Integrating risk, policy, and adaptation for resilient growth

The Economy and climate change link productivity, risk, and policy in ways that shape investment decisions and long-run growth. The economic impacts of climate change are visible through damaged infrastructure, higher maintenance costs, and volatility across sectors. Heat stress lowers worker output, extreme weather disrupts transportation and supply chains, and shifting precipitation patterns modify energy demand and agricultural yields, all feeding into a broader climate risk and policy narrative that governs incentives and financial decisions.

Policy design can steer this relationship toward resilience and sustainable expansion. Carbon pricing, emissions trading, and resilience-oriented public investments recalibrate cost structures to encourage adaptation strategies for businesses such as diversified sourcing, weather-informed demand planning, and energy efficiency upgrades. When well crafted, these policies support the green economy transition while helping households and firms price climate exposures more accurately and reduce systemic risk.

Green finance and investment: fueling the green economy transition through policy and markets

Financing the transition requires blending public funding with private capital and innovative instruments like green bonds and resilience funds. Climate finance and investment flows are essential to deploying zero-emission technologies such as solar, wind, and storage, while also supporting climate-resilient infrastructure that protects communities and assets from shocks.

Market signals and policy clarity matter for accelerating the transition. Transparent climate risk disclosures, strengthened risk governance, and targeted guarantees can attract private investment and price risk more accurately. The green economy transition opens opportunities for new jobs in renewables, energy efficiency, and climate-smart sectors, and deliberate adaptation investments help safeguard profitability and resilience in the face of climate variability.

Frequently Asked Questions

What are the key economic impacts of climate change on businesses, and how can climate risk and policy mitigate them?

Climate change raises infrastructure damage, productivity losses from heat, and input price volatility, which press margins and raise borrowing costs. Climate risk and policy tools—such as carbon pricing, emissions trading, and public resilience investment—can steer capital toward lower-carbon, more resilient options and reduce systemic risk. Enhanced risk disclosure helps markets price risks accurately, while targeted adaptation measures—like resilient supply chains, energy efficiency, and cooling—protect profitability and competitiveness.

How can the green economy transition support adaptation strategies for businesses and attract climate finance and investment?

The green economy transition creates demand for low-carbon technology, energy efficiency, and climate-resilient infrastructure, unlocking new investments and jobs. Firms that adopt adaptation strategies for businesses—diversified suppliers, weather analytics, and resilient facilities—reduce exposure and capture green-growth opportunities. Climate finance and investment instruments (green bonds, resilience funds) and transparent disclosures attract capital, while policy signals and international collaboration speed deployment.

| Aspect | Key Points |

|---|---|

| Introduction | Economy and climate change intersect to affect productivity, risk, and profitability. Policy responses shape incentives and investment decisions; adaptation reduces harm while preserving competitiveness. |

| Economic Impacts of Climate Change | Infrastructure vulnerability and maintenance costs rise; productivity losses from heat; agricultural yields and prices become more volatile; inflationary pressures and financial sector risk increase. |

| Policy, Markets, and the Economy | Carbon pricing, emissions trading, and regulations steer investment toward low-carbon tech and resilience. Public investment complements private finance; markets price climate risk and demand transparency. |

| Adaptation and Resilience | Firms diversify supply chains, use weather analytics, and invest in energy-efficient and resilient systems. Households benefit from efficient utility access and risk-informed public programs. |

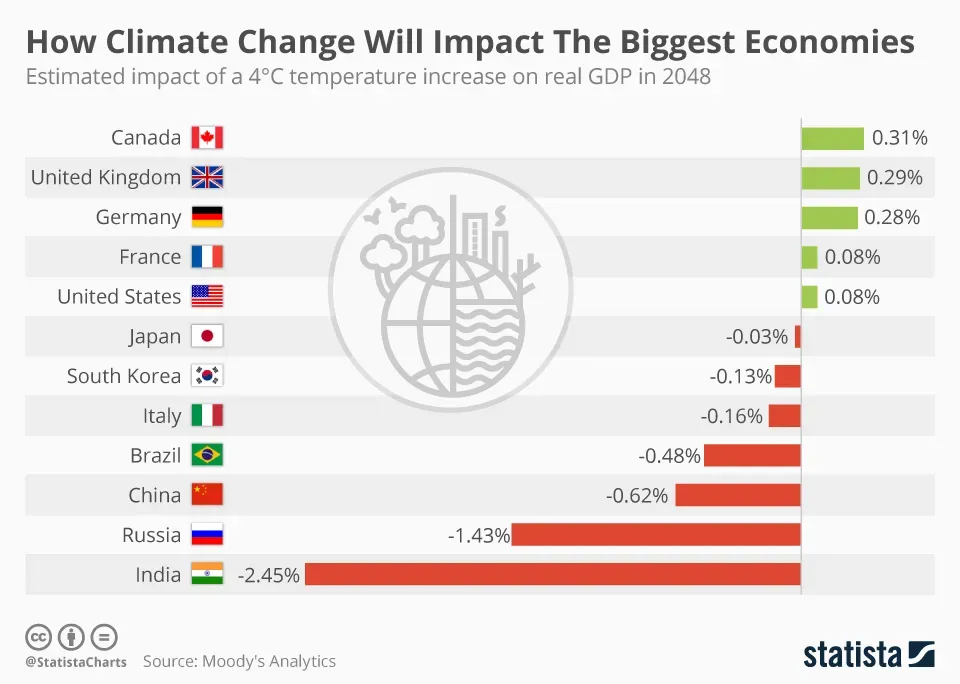

| Sectoral and Regional Variations | Different sectors face climate risk differently (agriculture, energy, tourism, manufacturing). Regional variation exists: some areas gain from a green transition, others face transitional challenges. |

| Financing the Transition and Managing Risk | A mix of public funds, private capital, and instruments like green bonds and resilience funds; risk-sharing and insurance; climate risk disclosure to improve market discipline. |

| Opportunities Amid Challenges | Green economy investments can drive innovation, jobs, and productivity gains; long-run growth may become more stable with lower climate-driven volatility. |

| Policy Recommendations for a Resilient Path | Integrate climate risk into macro planning; provide predictable policy signals; enhance climate-related disclosures; invest in education/training; foster international collaboration on finance and tech transfer. |

Summary

Economy and climate change are deeply interconnected in ways that shape policy, markets, and livelihoods. A comprehensive approach—recognizing economic impacts of climate change, aligning incentives, and investing in adaptation and resilience—can reduce vulnerabilities while enabling sustainable growth. By coordinating actions across sectors and borders, economies can seize opportunities from the green transition and build long-term prosperity.