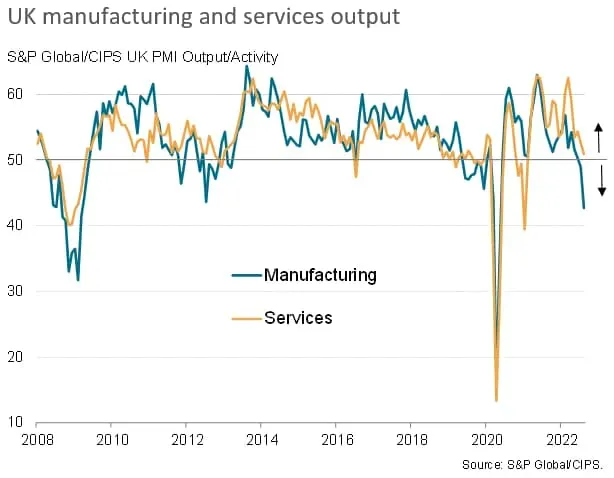

The recent contraction in the U.K. economy has raised significant concerns among analysts and policymakers alike. Data released this past Friday indicated that the U.K. economy contracted by 0.1% in May, marking a disappointing trend following a 0.3% decline in April. The anticipated growth had shifted, as experts predicted a modest increase, but instead, the ramifications of ongoing economic uncertainty in the UK and U.S. tariffs’ impact are taking their toll on growth prospects. This downturn has generated heightened discussions surrounding the UK GDP decline and has put pressure on the Bank of England’s previously optimistic growth forecast for the coming years. As Britain navigates through these hurdles, a recently secured UK trade deal with the U.S. stands as a pivotal factor amidst the backdrop of fluctuating economic conditions.

Taking a broader perspective, the current economic slowdown in the United Kingdom underscores a critical juncture for financial stability. Recent statistics reveal a decline in the nation’s economic output, indicative of a shrinking gross domestic product (GDP) and underscoring the myriad challenges that confront local economies. The uncertainty surrounding trade dynamics and regulatory changes adds further strain, prompting questions about Britain’s future economic direction. With a notable decrease in domestic activity and rising job market concerns, this phase of economic contraction may have significant implications for various sectors. As the nation braces for upcoming growth assessments, including the forthcoming GDP estimate, stakeholders must remain vigilant in adapting to the evolving landscape.

U.K. Economy Contraction: Recent Trends and Implications

In May, the U.K. economy experienced a contraction, with the gross domestic product (GDP) declining by 0.1% compared to the previous month. This downturn comes as a surprise to many analysts who had predicted a slight increase. The situation reflects ongoing economic uncertainty in the U.K., exacerbated by recent global trade tensions and domestic policy adjustments. Such fluctuations in GDP can significantly affect future economic forecasts and raise concerns about the stability of the U.K. economy as it navigates these troubled waters.

The contraction follows a 0.3% decline observed in April, which further complicates the economic landscape. Factors contributing to this decline may include the repercussions of recent tax changes and heightened operational costs due to U.S. tariffs impacting U.K. exports. As businesses grapple with rising costs and economic hesitance, understanding the implications of these contractions becomes crucial, both for policymakers and individual stakeholders monitoring the U.K. economic climate.

The Impact of U.S. Tariffs on U.K. Economic Stability

The imposition of U.S. tariffs has raised significant concerns regarding the prospects for U.K. trade. A 10% ‘reciprocal tariff’ from President Trump specifically targets sectors critical to the U.K., despite a generally balanced relationship in goods trading. Analysts have pointed to this tariff as a catalyst for further economic uncertainty in the U.K., as it places pressure on already struggling industries and hampers growth forecasts for the coming months.

While the U.K. has successfully negotiated a trade deal with the U.S., the benefits of this agreement may not fully outweigh the ongoing impact of tariffs imposed on specific goods. The complexities of international trade relationships coupled with internal market challenges heighten the risks associated with the U.K. tariff structure. As the Bank of England strives to balance growth forecasts, it becomes increasingly essential to monitor how these tariffs influence the wider economic picture.

Frequently Asked Questions

What factors are contributing to the U.K. economy contraction in 2024?

The U.K. economy contraction in 2024 is driven by multiple factors, including a decline in GDP by 0.1% in May, following a 0.3% contraction in April. Key contributors include domestic tax increases, economic uncertainty stemming from U.S. tariffs, and fluctuations in global markets. The ongoing need to navigate trade agreements, particularly with the U.S. and the European Union, also compounds these challenges.

How is the UK GDP decline affecting future economic forecasts?

The UK GDP decline is prompting economists to reevaluate future growth forecasts. Following the contraction in May, the Bank of England’s growth forecast for 2025 has been modestly set at 1%, reflecting anticipated economic deceleration for the remainder of the year due to a weaker job market and persistent economic uncertainty.

What impact do US tariffs have on the U.K. economy?

US tariffs have significantly impacted the U.K. economy by introducing reciprocal tariffs that affect trade. The imposition of tariffs has led to increased uncertainty for U.K. businesses, constricting trade capacity and negatively influencing GDP growth. The situation is further complicated by ongoing trade negotiations with other partners, making it crucial for the U.K. to adapt to these economic pressures.

Is the economic uncertainty in the UK expected to continue, and for how long?

Yes, economic uncertainty in the UK is expected to continue due to various factors, including slow GDP growth forecasts and a weaker job market. Economists predict sustained uncertainty throughout 2024 and beyond, particularly as the country navigates complex international trade relationships and domestic economic conditions.

What is the Bank of England’s growth forecast for the UK economy and what does it mean?

The Bank of England has projected a growth forecast of 1% for the UK economy in 2025, suggesting a slow recovery from the recent contractions. This modest figure indicates challenges ahead as the economy strives to stabilize amidst various uncertainties, including job market weaknesses and the impact of global trade dynamics.

What are the implications of the UK trade deal with the US on the economy?

The UK trade deal with the US is intended to bolster economic relations and facilitate trade after the imposition of tariffs. While this deal is a positive step towards improved economic stability, the ongoing economic contraction and uncertainty may hinder immediate benefits, requiring careful monitoring and adaptation to fully realize its potential.

Are there any signs of recovery in the UK economy following the contractions?

While there were expectations for a slight monthly increase in GDP in May, overall signs of strong recovery in the UK economy are limited. Analysts remain cautious against over-optimism, given the potential downside risks affecting Q2 forecasts and the overall economic outlook.

When will the next estimate of UK GDP be released and why is it significant?

The next estimate of UK GDP is scheduled for release on August 14, and it is significant because it will provide updated insights into the economic performance following the contractions observed in previous months. This information is crucial for assessing the trajectory of the U.K. economy and for making informed decisions regarding fiscal and monetary policies.

| Key Point | Details |

|---|---|

| U.K. Economy Contraction | The U.K. economy contracted by 0.1% month-on-month in May. |

| Previous Contraction | There was a prior contraction of 0.3% in April. |

| Analyst Expectations | Analysts expected a 0.1% increase in GDP for May instead of the contraction. |

| Global Trade Factors | Tariffs announced by the U.S. President introduced business uncertainty affecting the U.K. economy. |

| Trade Relationship with U.S. | Despite tariff challenges, the U.K. secured a trade deal with the U.S. |

| Economic Recovery Projections | Robust growth of 0.7% in Q1 is not expected to continue in subsequent quarters. |

| Future Growth Predictions | Growth is expected to decelerate, with the Bank of England predicting 1% growth in 2025. |

| Expert Insight | Sanjay Raja warns of downside risks to Q2-25 and annual growth forecasts. |

Summary

The U.K. economy contraction in May has raised concerns regarding the economic health of the nation, as GDP fell by 0.1% contrary to expectations of growth. Following a prior contraction in April, it is evident that ongoing trade tensions and domestic uncertainties are looming over the economic landscape. Analysts predict that this declining trend may persist, urging caution about future growth despite recent trade agreements.